PROSPERITY FOR ALL

CONTEMPORARY HUMAN SOCIETIES

Different kinds of human societies and different kinds of political, social, and economic systems simultaneously exist on Earth. Contemporary human societies run the gamut from tribal-based societies to agricultural-based, industrial-based, and information-based societies. Human economic systems run the gamut from capitalist-based systems to socialist-based systems and communist-based systems. Human social systems run the gamut from egalitarian systems to rank systems, caste systems, class systems, and even racially-based and gender-based social systems. Human political systems run the gamut from chiefdoms [(that is, rule by a (several) tribal leader(s), to democracies (that is, rule by citizens or their elected representatives), aristocracies (that is, rule by hereditary nobility), plutocracies (that is, rule by the wealthy class), autocracies (that is, rule by a dictator), and centrally controlled bureaucracies (that is, rule by committee)]. On top of these political, economic, and social differences between human societies, different languages, currencies, manners of dress, lifestyles, religious belief systems, and so forth, also exist.

No particular one kind of society seems to be capable of yielding a state of utopia for its citizens. Some types of societies do tend to perform certain tasks better than others. For instance, the free-enterprise economic system tends to excel at generating personal wealth. The free-enterprise economic system tends to excel at providing consumers with a wide array of consumption choices. Command-based economic systems seem better suited for planning and completing large-scale public works projects such as constructing a national dam. When funds are available, command-based economies seem better equipped to complete national infrastructure modernization projects because all of the decision-making is centralized. Equality of opportunity and meritorious types of social structures seem to promote greater social mobility for all citizens in a given society. One thing is certain about human societies, and it is this: With the passage of time, more and more humans from all societies across Earth are migrating to urban areas in search of a more prosperous life.

Additionally, with the passage of time, the trend appears to be that more and more humans are obtaining a college-level education as shown in the following chart.

Given the free-enterprise system's proven track record for generating wealth, this discussion of "Prosperity for All" is framed within the context of living under the free-enterprise model. As I noted on the "Food for All" page of this website, if given a choice, most humans probably would opt to live the good [or prosperous] life. On the "Human Condition" page of this website, I noted that the human desire to consume goods and services virtually is limitless; there is no limit to the quantity of products that humans would consume if those products were available for free. On the "The Good Life" page of this website, I noted that it takes money to live the good life in modern human societies.

On the "Food for All" page of this website, I noted that a conflict exists between the desire of a growing (and increasingly urban) human population to live the good life, on the one hand, and Earth's limited natural resources, on the other hand. How can there be prosperity for all humans on Earth while simultaneously maintaining a reasonable degree of environmental purity? How can there be prosperity for all humans on Earth given the Earth's limited natural resources? How can there be prosperity for all humans on Earth given the need to conserve the Earth's natural habitats and also given the need to preserve the Earth's ecological equilibrium? How can there be prosperity for all humans on Earth given an exponentially growing human population on a finite planet Earth? To be sure, it is a delicate balancing acts to reconcile these conflicting demands and patterns. I believe that the free-enterprise system of supply, demand, and price coupled with astute land use planning and the deployment of smart and eco-friendly engineering solutions are more than capable of addressing this conflict between the limitless human demand to consume all kinds of products, on the one hand, and the limited space, limited natural resources, and the need for ecological preservation on Earth, on the other hand. Admittedly, by its very nature, achieving a state of economic prosperity for all signifies the use of more natural resources to power that prosperity.

A key to realizing prosperity for all seems to lie both at the macro (societal) and micro (household) levels. For developing countries, national governments must work with the private sector to coordinate future development plans. Citizens must rely on a national action plan to make the transition from underdevelopment to modernity. Whereas the details of these macro-level plans might emanate from the academic community, the national government normally would play a leading role in approving, coordinating, and marshalling the required resources to implement such macro-level national plans. The national government would take responsibility for fostering a bidding and contracting process.

The aim of these macro-level plans is to build a national infrastructure to support modern living, namely, national transportation networks; communications networks; water and waste treatment systems, power grids; farm and irrigation networks; bridges; school systems; banking systems and financial networks; national parks and open space; and so forth. A viable national infrastructure is essential to attracting private business activities. Businesses need a solid infrastructure to be in place so that they effectively could function. Moreover, in his book titled The Economics of Poverty, Alan Batchelder aptly noted that a key prescription for ending poverty is for a citizenry to have access to capital to work with, that is, access to buildings, factories, machinery, tools, heavy equipment, computers, and so forth.

When introducing these macro-level development solutions into society, political stability and political maturity in a country are assumed to exist. It is extremely difficult to get things done or to foster economic development in a societal milieu besieged by perpetual political turmoil, political bickering, political corruption, election sabotage, voter fraud, election violence, and so forth. At some point or another, the citizens of a country (or their elected representatives) must decide to peacefully debate an issue, take a vote, adopt a course of action, set aside their differences, implement the course of action, and move on to tackle the next societal issue. It is unsportsmanlike to be a sore loser by perpetually trying to contest the validity of an already debated, voted on, and enacted law.

Common sense should dictate that you win on some political issues and you lose on other political issues. Nobody in politics should expect to win 100% of the time on every single issue or to win 100% of the time on every single vote. To be sure, no political party has all of the answers for a society's problems, issues, challenges, and so forth. Even Sir Isaac Newton and Albert Einstein, who arguably represented two of the greatest scientific minds to have ever walked the face of this Earth up to this point in human history, did not have all of the answers in their respective fields of study. The 100% righteous approach to politics does not work in a democracy. If USA citizens agreed that one political party was 100% correct all of the time, then it follows that 100% of local, state, and national elective offices would be held by the political party deemed to be 100% correct. In reality, both Republicans and Democrats hold numerous elective offices at the local, state, and national levels of USA government. The 100% righteous approach to governance in a democracy is a fallacy, but majority rule is not a fallacy. Obedience to majority rule is one way in which members of society consciously have agreed to govern themselves or to conduct their affairs in a civilized manner.

SIDEBAR: Democracy in the USA |

|---|

|

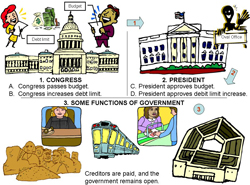

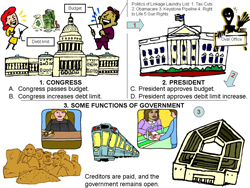

Countries like China, India, Japan, Iraq, Iran, and the countries of Europe have long histories of civilized living despite lots of revolution and evolution during the intervening years. These countries have instituted and experienced formal systems of government for thousands of years. The USA is a relatively new civilized society. As of 2013, it only has been 237 years ago since the USA colonists declared their independence from the British crown. The USA colonists began forming the USA's present form of government in 1776 at the close of the 18th century. The formation of the present-day USA government began in earnest at the 1783 conclusion of the American Revolutionary War against Great Britain. Lately, at the dawn of the 21st century, the USA has begun exhibiting signs of being an unstable and immature democracy. Take the current political stalemate and government dysfunction in Washington, D.C. as of September 2013, for instance. The crux of the problem is the inability of Democrat and Republican representatives to reach agreement on various partisan political issues. During July of 2011, in the debate over raising the federal debt limit, the Republican representatives successfully deployed the politics of linkage. Now, in September 2013, the Republicans seem to be attempting to make linkage a permanent feature of American governance. Notably, it is quite possible to have a full government shutdown or a partial government shutdown in the USA even without the politics of linkage. For instance, enough members of one political party could refuse to vote in favor of a spending bill if they vehemently disagree with the contents of the spending bill. The politics of linkage is different, however, because you have members of one political party who are threatening to shutdown the entire government and who are threatening to default on the nation's debt obligations to the entire world unless the opposing political party agrees to one or more of their obscure political objectives. The political objective in question usually reduces to a fraction of the overall scope of the federal government or reduces to a fraction of federal governmental monetary outlays. In essence, the politics of linkage reduces to punishing the entire country (in the case of a federal government shutdown) and punishing the entire world (in the case of a federal government default) simply because a few (for example, the Tea Party faction of Republican representatives) cannot get to have things done their way. The politics of linkage reduces to a form of selfishness in that the political interests of a few (for example, the Tea Party faction of Republican representatives) begin to prevail over and overwhelm the principle of majority rule. The political interests of a few begin to take precedence over everybody else in the world who rely on the USA government to honor its financial obligations. How does the politics of linkage work? In the USA, it is the duty of Congress to fund the government. Only Congress and Congress alone is empowered to initiate legislation to fund the government. After Congress initiates and passes legislation to fund the government, the legislation then goes to the President for final approval. The President is empowered to approve or veto Congressional budgetary legislation, but the President is powerless to act until the legislation arrives from Congress (that is, the President is powerless other than issuing executive orders). It also is the duty of Congress to raise the federal debt limit to avert defaulting on federal payments to creditors and beneficiaries. Again, the President is empowered to approve or veto Congressional increases to the federal debt limit, but the President is powerless to act until the debt limit legislation arrives from Congress. The first hurdle to overcome would be for the legislation to pass a vote in Congress before it moves to the President for final approval. The second hurdle to overcome would be for the President, in fact, to approve rather than to veto the legislation. If the President vetoes the budgetary legislation, then Congress will have an opportunity to override the President's veto (which would be the third hurdle to overcome); otherwise, there is a political impasse. In the event of a political impasse, it appears that one logical crisis-avoidance solution would be to pass a law that stipulates the federal government automatically will be financed at current levels and the federal debt limit automatically will be raised until such time the political parties in power in the two houses of Congress including the President can reach agreement on final legislation. In short, one solution would be to pass a law to end the fiscal insanity or politics of linkage once and for all. The politics of linkage is this: In this particular instance, as of 2013, Republicans have taken the position that, before they would consider funding the federal government and before they would consider raising the federal debt limit, first they want Democrats to make concessions on public policy issues that are important and dear to Republicans. As of 2013, Democrats have taken the position that, these other kinds of partisan public policy issues should not be linked to a resolution to temporarily fund the government or linked to a vote to raise the federal debt limit. The Democrats seem to be arguing that there is a time and a place to take up these extraneous public policy issues, and a Congressional vote to temporarily fund the federal government or a Congressional vote to raise the federal debt limit should not be linked to the opposing political party's laundry list of public policy preferences. The following two graphics illustrate the politics of linkage. Click each graphic to see a larger picture.

Did you detect the difference between the two graphics? The top graphic illustrates holding a political debate and having a so-called clean vote to temporarily fund the government or holding an unencumbered vote to raise the federal debt limit. The bottom graphic also illustrates holding a political debate but a Republican representative is depicted as reaching into his pocket and producing a laundry list of public policy conditions that must be met before affirmatively voting to temporarily fund the government or before affirmatively voting to raise the federal debt limit. Insertion of the laundry list is the Republican equivalent of pulling a rope-a-dope move on the Democrats. Republicans generally agree that a budget needs to be passed and that the federal debt limit needs to be raised, but before they give their approval, they want the Democrats to make concessions to Republican public policy preferences such as the following ones:

Obviously, if the Republicans can convince the Democrats to consider debating these extraneous public policy issues in exchange for a favorable Republican vote to temporarily fund the government or in exchange for a favorable Republican vote to raise the debt limit, then the Republicans will have scored a victory. If the Republicans can convince the news media to keep these extraneous public policy issues as the topic of conversation and at the center of attention, then the Republicans will have scored a victory. If the Republicans can generate enough public pressure to cause Democrats to focus on the Republicans's laundry list of conditions instead of focusing on the real issues at hand—a resolution to temporarily fund the government or a vote to raise the federal debt limit—then the Republicans will have scored a victory. If the Republicans can convince Democrats to make concessions much like the Democrats made concessions to the Republicans during the July 2011 debt limit debate, then it would be a victory for the Republicans. The reason why it would be considered a Republican victory is because, in this particular instance, the Republicans are the ones who have reached into their pockets, pulled out a laundry list of conditions, and are confusing the task at hand of temporarily funding the government or raising the federal debt limit. In this particular instance, the Democrats have not produced a comparable laundry list of conditions and are not asking for any type of partisan public policy concessions from the Republicans. The Republican strategy reduces to a one-way submission by Democrats to a laundry list of Republican demands. To equalize the negotiations, the Democrats also would need to reach into their pockets and produce their own laundry list of conditions such as the following list:

Alternatively, the Democrats would need to convince the Republicans to drop the extraneous public policy issues from the equation and return to the original tasks at hand, that is, the task of temporarily funding the government until a budget is formally adopted and the task of raising the federal debt limit. Of course, one of the reasons why the Democrats are not making comparable demands in this particular 2013 instance is because a fellow Democrat is in control of the Presidency. While the Republicans might have a vested electoral interest in seeing a Democratic President fail, Democrats have a vested electoral interest in seeing a Democratic President being deemed by historians as having presided over a successful Presidency. For now, as of 2013, with a Democratic President in power, the Democrats seem to have opted to take the high road. The Democrats seem to have opted not to play the politics of linkage with a resolution to temporarily fund the government or with a vote to raise the federal debt limit. For now, as of 2013, the Democrats do not seem interested in advancing their own list of public policy concessions or do not seem interested in making their own list of conditions a point of contention. The Democrats seem to be adopting the position that there is a time and a place to take up all of these partisan public policy issues during the regular course of Congressional business. The Democrats seem to be adopting the position that a vote on whether to temporarily fund the government and a vote to raise the federal debt limit should not be mixed with extraneous public policy issues. It should be noted that the high-road posture of the Democrats suddenly might change if a Republican candidate should become elected as President of the USA. President Obama seems to be arguing that the federal government's obligation to keep the federal government running is so vital to the national interest until it is a bad precedent to engage in the politics of linkage with this particular function of government. President Obama seems to be arguing that the federal government's failure to pay its creditors and to pay its beneficiaries has such sweeping and broad-based adverse ramifications for both the domestic and global economy until it is a bad precedent to engage in the politics of linkage with this particular function of government. President Obama seems to be saying that paying creditors and keeping the government running should be off limits to the politics of linkage. To use a household analogy, the President seems to be saying that it would be unreasonable to link your monthly home mortgage payments to a disagreement with your spouse over, say, a vacation destination. It would be unreasonable for one spouse to say to the other one, "If we don't go on a cruise to Mexico for vacation this year, then all mortgage payments will cease." The reasonable thing to do would be to continue making the mortgage payments on the 1st of each month while resolving the vacation dispute with your spouse on some other day of the year before summertime or vacation time arrives. Why would you default on your home mortgage payments [or on the national debt] simply because you cannot agree with your spouse on a vacation destination [or on Obamacare]? You wouldn't default on your mortgage. President Obama's point appears to be this: A household's obligation to make its monthly mortgage payments should have nothing to do with its choice of a vacation destination. By the same token, a decision to temporarily fund the government should not be linked to making extraneous public policy concessions such as defunding or delaying Obamacare. Why would you go and burn down your house simply because you cannot agree with your spouse over a vacation destination? You wouldn't burn down your house. By the same token, in the case of Congress not raising the debt limit, President Obama appears to be saying this: The decision to raise the federal debt limit should not be linked to making extraneous public policy concessions such as re-negotiating a previously approved budget. To put it another way, the politics of linkage is akin to a few immature, stubborn, impetuous, and irresponsible individuals deciding to shutdown the entire Internet simply because they could not get to have things done their way regardless of the number of adversely impacted Internet users all over the world. The irony of the stubborn and inflexible stance by a few (for example, the Tea Party faction of Republican representatives) is this: Instead of the prospect of saving money for the USA federal government, say, by abolishing Obamacare, if the USA federal government actually should default and if the credit rating agencies actually should downgrade the USA federal government's credit rating, not only will the scenario of default put worldwide investors in USA financial instruments and put beneficiaries of USA monthly income payments at the risk of not being paid but also the scenario of a downgrade in the government's credit rating will cause all USA citizens to lose money due to higher interest rates and will cause the USA federal government to lose money due to higher borrowing costs. Over the long run, the higher interest rates paid by USA citizens and the higher borrowing costs paid by the federal government very well could easily have the net impact of surpassing the projected $940 billion, 10-year cost of Obamacare. Perhaps the larger point to remember is this: USA society will not disappear from Earth and the Earth will not stop spinning due to incessant political bickering by Democrat and Republican legislators over, say, a contentious political issue such as Obamacare. The important thing for citizens to do is to remain cool, calm, and collected. The important thing for citizens to do is to not allow themselves to be swept away by the political slogans, theatrics, posturing, grandstanding, showmanship, and power mongering in Washington, D.C. as captured by the news media. The USA federal government is not in crisis. USA democracy is not in crisis. It is only the USA Congress that is in crisis. In 2011, the hot-button political issue was the national debt. In 2013, the hot-button political issue seemed to be Obamacare. You can rest assured that, in 2014 and beyond, Democrats and Republicans will find yet another hot-button political issue over which to squabble and vehemently disagree with one another; it seems to be the nature of partisan politics. However, USA politicians have to decide whether to address these political issues in a mature and responsible manner in the interest of moving the nation forward into futuristic living or whether to address these political issues in an immature and irresponsible manner based strictly on allegiance to political party dogma to the detriment of the nation. The USA Congress already knows that, all other things being equal, the overall debt of the federal government is projected to rise to at least $20 trillion by the year 2018. Why should the USA Congress irresponsibly and immaturely throw the federal government into a crisis over a debt limit that it already knows has to be raised for at least the next several years? The politics of linkage is an irresponsible, dangerous, and unnecessary game; peoples livelihoods are at stake if the economy should implode due to political impasse and paralysis. The legislative process in Congress appears to be rigged to perpetuate gridlock. How is it that one (or a few) stubborn legislators could bring the entire USA government to a halt? Can you imagine the chief executive officer (CEO) of a major USA corporation not being able to run the corporation simply because one lone employee within the corporation has the power to veto the CEO's decision? Effectively, it is a scenario whereby the CEO's hands could be tied by this one lone employee, and the entire corporation could be brought to a complete standstill at the whim of this one lone employee? In reality, this one lone employee would be fired so quickly until his or her head would spin. This type of scenario will never happen in the corporate world, but it is precisely what is happening in Congress. This type of scenario will never happen in the corporate world because the rules of operation in the corporate world would not permit it to happen. (I think that many of you are familiar with Donald Trump's The Apprentice, which depicts how that one lone employee would get dealt with as the business of the corporation keeps moving along uninterrupted.)

How is it that the political interests of a few (for example, the Tea Party faction of Republican representatives) possibly could lead to the paralysis and destabilization of the entire federal government? The USA mainly is a two-party political system of government. The USA's political system operates on the basis of majority rule. The USA federal government is constitutionally structured on the principle of three co-equal branches of government (that is, the executive, legislative, and judicial branches) with both a separation of powers between the branches and also with constitutional checks and balances of the three branches over the authority of the other. Within this two-party political system and its three branches of government, after debating and voting, the majority vote is supposed to carry the day. By way of majority decree, the larger national interest is supposed to preempt or take precedence over more narrowly focused political party dogma. For instance, a debate over the provisions and implementation of Obamacare would be classified as a narrowly focused partisan issue in that not all members of society are impacted by it. A vote to keep the entire federal government open or a vote to not default on the national debt is something that affects the interests of the entire nation and also the interests of the entire world. In other words, Congress should not play politics with a vote to keep the federal government open or a vote to not default on the national debt. The USA federal government has become adept at passing laws to regulate the private business sector. The USA federal government has become adept at telling private businesses and private citizens what to or what not to do (usually for the larger public good). Is the USA Congress capable of putting its own operations under the same critical microscope? Is the USA Congress capable of reforming its own internal operational rules? Does the USA Congress have the courage to follow the recommendations of an independent auditor when it comes to reforming its own internal operations? The remedy to the Congressional crisis is very simple—reform the way it operates. A classic case in point is how one representative is empowered with the authority to prevent the entire Congress from even considering, say, a Presidential court appointee. Congress ought to consider reforming its operational rules so as to minimize political dysfunction in its daily operations, not change its rules so as to maximize political dysfunction. Congress ought to consider reforming its operational rules so as to take the minority party's wishes under consideration while simultaneously making it less likely that a few of its members would be in a position to bring the entire government to a grinding halt. In the tradition of Schoolhouse Rock, it is time for Congress to stop the political shenanigans. It is time for Congress to get back to the basics of governing as the Founding Fathers intended and as illustrated in the following two videos:

|

In a stable and mature democracy anywhere on Earth, the political pendulum perpetually seems to swing from left, to center, to right, and then to swing in the reverse direction. When one political party imposes its will and seeks to have things done its way 100% of the time, then it is no longer called a democracy. It is called totalitarianism and tyranny. In a stable and mature democracy, politicians from different political schools of thought should be prepared to compromise, to form coalitions, and so forth, if they wish to legislatively accomplish some of the things they want. The idea behind a democracy is spirited debate, an exchange of ideas, engaging in negotiations, reaching a compromise, and voting to adopt a course of action.

One thing is certain about "prosperity for all," and it is this: Business leaders do not like to locate in (nor do tourists wish to visit) places on Earth where there is constant political upheaval, work stoppages, and general uncertainty. Business leaders do not like to locate in (nor do tourists wish to visit) places where you have rebels and thugs running around shooting up the country, taking hostages, and murdering their perceived opponents. Business leaders do not like to locate in (nor do tourists wish to visit) places where you have disaffected citizens detonating bombs in cars and detonating bombs in other public spaces. Business leaders do not wish to locate in (nor do tourists wish to visit) places where you have constant rioting, social upheaval, rampant crime, kidnappings, and destruction of property.

Business leaders like to locate in (and tourists like to visit) places where their business facilities will be safe as these facilities usually reflect a huge monetary investment. Business leaders like to locate in (and tourists like to visit) places where they are assured of societal stability and personal safety. Business leaders like to locate in places where they are assured of continuity of business operations.

National leaders have a delicate tightrope to walk. On the one hand, national leaders have to make the economic climate of their countries as friendly and inviting to businesses and tourism as possible. On the other hand, national leaders have to ensure that the profit motive of businesses do not conflict with or overwhelm the broader public interest. Supposedly, one tradeoff for making a country's economic climate as friendly and inviting as possible to businesses is the jobs and stable tax sources that private business activities normally generate.

Attaining modernity in a country where social stability has been lacking will not be a simple feat to accomplish. Attaining modernity in a country where religious fanaticism is prevalent will not be a simple feat to accomplish. Attaining modernity in a country where a preoccupation with the practice of witchcraft, sorcery, animism, and magic is widespread will not be a simple feat to accomplish. These various obstacles to modernity will not be easy to overcome.

For citizens of developed countries, micro-level solutions seem to be the more appropriate route to follow in achieving prosperity for all. These micro-level solutions also are applicable to citizens living in developing countries. The key difference between citizens living in developed countries and citizens living in developing countries is the need for a national infrastructure to exist to attract private businesses to developing countries. In developed countries, the national infrastructure already exists, and private businesses already are flourishing.

What are these micro-level solutions for "prosperity for all" in developed countries? These micro-level solutions revolve around things such as obtaining a career-focused education and acquiring both money management and business management skills. As I noted on the "The Good Life" page of this website, these money management skills include mastery of principles such as budgeting, earning money, spending money, saving money, borrowing money, investing money, and small business management. Success in the area of personal financial management is contingent on self-discipline and strict adherence to these personal financial management principles beginning at a very early stage in life.

Just as certain as humans are not born equal, all citizens of a country will not become monetarily rich during their lifetimes. I do believe, however, that it is possible for all humans to attain a measure of economic stability and financial security in life. In the debate over income inequality, I know that, for some, it is fanciful to portray the very rich as villains. Is the founder of, say, an Internet company to be blamed because millions of humans demand, and are willing to pay a fee, to use his or her Internet product? Is the owner of the Internet company to be blamed because the company generates millions and perhaps billions of dollars annually in income? I think that the owner of the Internet company should be lauded for the company's accomplishments so long as the business is being operated in compliance with the law.

It is a business owner's prerogative whether to share his or her profits more equitably with his or her employees (albeit the employees will have already agreed to a pre-determined salary as a condition of employment); whether to invest the profits in research and development; whether to use the profits to expand the business and even perhaps to purchase other businesses; whether to move production of the product to foreign countries (in whole or in part) to further maximize profits; whether to transfer the profits to charity; whether to transfer the profits to his or her personal bank account to splurge on the purchase of estates and all kinds of glitzy consumer products, and so forth. Most highly successful and very wealthy entrepreneurs opt for a combination of these choices or prerogatives.

I agree with USA President John F. Kennedy. For it was President John F. Kennedy who asserted that, while all humans might not have equal talents, each human should be afforded an equal opportunity to fully develop whatever talent he or she does possess.

THE IMPORTANCE OF WORK IN SOCIETY: MAKING A LIVING

There are several adverse impacts in society that emanate from a lack of jobs. Some of these adverse impacts include the following:

- Households become reluctant to commit to future long-term financial investments, say, by purchasing a new home or purchasing a new automobile without stable or steady jobs. The reason for the reluctance is because households are not assured that they will have a future income stream to meet their long-term debt obligations. The days of "a job for life" appear to be a thing of the past.

- With unending job shortages, the chronically unemployed fail to acquire an appreciation and discipline for going to work and actually performing work. Already there appears to be too little passion for learning at school. With labor markets constantly in tumult, a corresponding decline in passion for working is expected to emerge. A corresponding decline in job loyalty is expected to emerge. A corresponding decline in job appreciation is expected to emerge. Rather than employees taking pride in working, employees will tend to view work as nothing more than a way to pay the bills.

- When stable and legal jobs are not available, then households either begin to seek governmental assistance for survival (such as welfare and unemployment payments), or due to desperation, either they resort to a life of begging and engaging in petty crimes to obtain money or they tend to turn to the underground economy for survival. People are not stupid. People are not going to simply sit around and deliberately allow themselves to starve too death if they can help it. [Evidence that people are not going to sit around and die if they can help it can be seen by the millions of refugees fleeing wars Africa in Africa and the Middle East and seeking refuge in various European countries during the 2010's.] If people do not have jobs but they desperately need the basic necessities of food and shelter, then they are inclined to do whatever is the most expedient thing for them to do to secure the required food, shelter, and clothing for their families. If people cannot find legitimate work in the regular economy, then they are more susceptible to be enticed to engage in illicit and illegal activities to acquire money. When people have to turn to the underground economy to make a living, then they tend to get involved with, and are inducted into, the lifestyle of crooks, swindlers, and murderers. A lot of sinister activities and treacherous behavior occur in the underworld. In her song titled "Feel No Pain," Sade very elegantly makes the case for decent-paying jobs in the regular economy. [It further should be noted that humans also are risk takers. Some humans prefer to work in the underground economy if they know that the pay is higher. For instance, when some humans know that they only can find part-time work in the regular economy that pays, say, $25,000 a year in taxable income whereas they can be selling, say, illicit drugs in the underground economy and making, say, $100,000 a year in tax-free income, then some decide to risk their lives by selling illicit drugs for a living. Furthermore, their employers in the underground economy might not require them to have a high school diploma or to have several years of prior work experience. For others, they choose to work in the underground economy because they enjoy the lifestyle.]

- A fourth adverse societal implication of low job opportunities in society is that citizens do not acquire the proper discipline to follow a chain of command. To get things done in society, command-and-control processes need to exist. When citizens obtain employment, one of the first things that they learn is the need to comply with the company's organizational structure. This structure consists of a chain of command for planning, organizing, directing, and controlling the operation of the business. The organizational structure generally includes the chief executive at the top of the hierarchy followed by top managers, middle-line managers, first-line managers, and rank-and-file workers, respectively. Some businesses operate on the basis of a top-down management style, which means all the orders come from the top of the hierarchy and work their way down to the bottom. Other businesses operate on the basis of a bottom-up management style, which means that all employees in the business are encouraged to offer suggestions to make the business more efficient and more effective in accomplishing the company's goals.

- A fifth adverse societal implication of joblessness is that citizens do not receive proper assimilation into society. Except mass media influences, school and work are two venues in which citizens become assimilated into the broader civil society. If citizens do not have jobs, then they begin to lose their sense of purpose and self-confidence. They begin to think that they do not have a stake in society. They begin to lose their self-esteem and sense of self-worth. They begin to feel useless and helpless. They also miss an opportunity to work with, and to get to know, their fellow citizens. These unemployed citizens begin to become detached and isolated from the broader society. They begin to rebel against the values of the broader society. They begin to use, abuse, and become addicted to substances as a means of coping with their plight and, at the same time, as a means of escaping their plight.

- A sixth adverse societal implication of joblessness is that some citizens use their experiences in private business as a basis for launching their own small businesses. After gaining experience in navigating various organizational structures and navigating the operational procedures of the companies where they work, some citizens become confident of their managerial abilities and decide that they have the wherewithal to operate their own businesses, or they have the insights to fill a specific business niche.

THE ROLE OF MATH AND THE IMPORTANCE OF EDUCATION IN HUMAN SOCIETY

Mastery of the fundamentals of household math and household finance requires a general understanding of basic arithmetic. Mastery of the fundamentals of household math requires knowing how to perform operations with numbers. In many real-world situations in the economic marketplace, you only need to know how to perform the four arithmetic operations of addition, subtraction, multiplication, and division. You can solve many math-related situations in life simply by knowing how to perform these four arithmetic operations.

An understanding of basic arithmetic is important because arithmetic involves the use of numbers. In turn, numbers are used to measure things. Numbers are used to represent amounts, quantities, sizes, distances, durations, gains, losses, and so forth. The key to making wise household financial decisions is knowing how to compute, interpret, and make the most advantageous uses of these amounts, quantities, sizes, distances, durations, gains, and losses.

The magic-square concept can be used to solve many household-related math problems. (Sometimes triangles are used instead of squares.) The magic square technique is limited to problems involving multiplication. In math, when solving for an unknown variable in an equation involving multiplication, you might need to use division to solve the equation based on which variable needs solving.

The magic-square concept presents a visual way to compute an unknown value for a variable when the other values are known. When using magic squares, place your finger over one of the squares. The remaining squares reveal the required formula to find the unknown value that is covered by your finger.

The following three formulas commonly are used to solve various household-related problems:

To illustrate the magic-square concept, assume you needed to make an emergency trip from San Francisco to Seattle. You will be traveling to Seattle by automobile. The emergency nature of the trip requires you to be in Seattle in 10 hours. How fast would you need to drive to arrive in Seattle on schedule? The rate-of-speed formula reveals that you would need to drive a minimum of 80 miles per hour to complete the 800-mile trip and reach Seattle in 10 hours.

| Solve for Unknown Rate of Speed, or Variable r | |

|---|---|

| r=d/t | |

| d | |

| r | t |

| 800 | r | 10 |

| r=80 | |

| Solution: r = d (800 miles) / t (10 hours) = 80 miles per hour | |

| MEANING: If you need to travel by automobile nonstop for a distance of 800 miles in 10 hours, then you would need to drive at a rate of speed of 80 miles per hour. | |

In the above table, given that the rate of speed or r is the unknown value, if you place your finger over the r, it reveals that the solution for r would be d/t or 800/10.

Education traditionally is hailed as the chief mechanism for achieving upward socioeconomic mobility in civil society. It has been noted that the first three years of primary school, or grades 1 through 3, are the most critical ones. Grades 1 through 3 are when children typically master the three R's, that is, Reading, wRiting, and aRithmetic. It has been noted that those students who do not master the three R's during these early school years are the ones most at risk for engaging in activities such as truancy and dropping out of school later in life. At a bare minimum, schools should redouble their efforts to make certain that all children master the three R's during grades 1 through 3.

The main purpose of education is to prepare students to become responsible, productive, and self-supporting members in contemporary society. Another purpose of education is to teach students how to behave civilly in contemporary society by leading principled and disciplined lives with the utmost respect for self, respect for others, respect for the property of others, respect for the rule of law, and respect for human life regardless of race, color, creed, ethnicity, gender, sexual orientation, religion, disability, national origin, socioeconomic birth status, political opinion, and so forth. The very essence of an Age of Homo Sapiens Sapiens is the human species rising above the Animal Kingdom and elevating its everyday conduct to the highest ethical plane instead of behaving like a pack of wild animals.

I believe that the time is come to deploy tracting in education. Tracting has nothing at all to do with the academically inclined students being smarter than, or somehow better than, say, the vocationally inclined students albeit it is inevitable that there will be those who draw such conclusions. Tracting has everything to do with placing students in classes and areas of interest that excite them. It has everything to do with placing students where they can excel to the fullest of their various talents and abilities. Tracting has everything to do with preparing students to become responsible, productive, and self-supporting members of society. Put simply, different students have different callings in life. Tracting is an attempt to match each student to his or her calling in life or to maximize a student's natural talents and interests. Students in all tracts should support one another in their quests to succeed in life.

Just as it is true that not everybody is a good dancer, salesperson, or business entrepreneur, it also must be conceded by educators and schoolteachers that not every student will excel at academics. Classroom courses such as chemistry, geometry, and physics simply will not appeal to all students. At the middle school and high school grade levels, I believe that it is very important for school systems to put as much emphasis on vocational courses (such as carpentry, plumbing, automobile mechanics, welding, sewing, landscaping, computer repair, and so forth), the arts (such as music, song, dance, theater, painting, drawing, sculpture, photography, film making, and so forth), and athletics (or all kinds of sports) as they do on academic courses.

After a non-academically inclined student has been taught the basics and can demonstrate a minimum competency in the basics of, say, reading, grammar, writing, spelling, math, history, civics, geography, and science, at some point in his or her educational career, the student ought to be moved over to the vocational, arts, or sports tract. For non-academically inclined students, the school system ought to focus on developing their vocational, artistic, or athletic interests to the maximum rather than keeping those students tied to a purely academic tract.

If the student could demonstrate mastery of a vocation, an art, or a sport as well as could demonstrate that he or she can read, write, and perform basic arithmetic computations, then this demonstration should be sufficient for him or her to receive the high school diploma. I believe that USA school systems tend to place too much emphasis on passing various standardized proficiency tests. A preoccupation with proficiency tests misses the larger point. The larger point is to graduate students who will become responsible, productive, and self-supporting members of society.

Those students who excel at academics could remain in the academic tract throughout high school. Those students who are more inclined for vocational, artistic, or athletics endeavors should be moved into those specific tracts at some point during their middle-school or high-school years. Put simply, some students might be infinitely more interested in auto-body repair, plumbing, horticulture, or cosmetology than they would be in, say, solving calculus problems.

At the same time, sight should not be lost of a critical fact: Any given society on Earth needs a cadre of mathematicians, scientists, engineers, architects, ecologists, land-use planners, and technicians who possess specialized knowledge to propel that society into futuristic, high-technology, and deep space types of living modes. This specialized knowledge can only be gained by students making the most of the educational opportunities that they are afforded in life, particularly, students who are proficient at mathematics, scientific, and technical thinking. These specialized kinds of jobs will be in very high demand in the future, and these mathematics, scientific, and technical professionals usually are paid well for the services that they provide to society.

All jobs are vital in society. All jobs have merit. Not everybody can be the chief executive officer of a corporation, and not everyone can be the corporation's chief technician. Someone needs to do the nuts-and-bolts, assembly-line work in society. All kinds of jobs need to be performed in society. There is no need for anyone to ever feel ashamed of the type of work that he or she does for a living as long as those jobs are legally recognized ones. There is a job niche for everyone in society.

For those who are interested in becoming wealthy, there are all kinds of ways to make lots of money in life. You do not have to be a genius to do make a lot of money in life albeit it certainly helps to be genius.

Education alone is not enough to foster prosperity for all. Education must be coupled with available job opportunities. When it comes to making a career choice, while it is a good thing to follow one's passion in life, you also have to be realistic and practical. You have to choose a career where you have a very good chance of finding a job. You have to maximize your chances of finding a job. Your ultimate goal in life is to become a responsible, productive, and self-supporting member of civil society. The question that each high school and college freshman should be asking himself or herself is this: What am I going to do to earn money to make a living after I graduate? What skills or knowledge do I need to possess to obtain a job and to excel in my chosen profession? The primary focal point of high school and college studies should be on obtaining those requisite skills and knowledge to obtain a job.

PROSPERITY FOR ALL: A MICRO-LEVEL BLUEPRINT FOR SUCCESS

Before the advent of the personal computer and before the advent of the Internet, it was rather tedious and cumbersome for households to perform personal-financial-planning chores. Today, there exists a plethora of automated or electronic personal-financial-planning tools and math aides in the economic marketplace. Many of these tools are available for free.

Nowadays, one does not need to be a mathematical prodigy to solve many of the math-related household problems that are encountered in daily life. Not only have the mathematical forebears of humans solved many of these problems but also they generously left behind the proofs and formulas that anyone can use to solve these math problems. The famous Italian mathematician, Leonardo Fibonacci, who was born in 1170 and died in 1250, is widely credited with being one of the first scholars in the West to use formulas to unravel the inner workings of, among other things, the time value of money as it relates to concepts such as compound interest. The financial formulas below represent the basic underpinnings of the time value of money. [It should noted that some of these mathematical discoveries originated in the ancient East. These discoveries were imported, perfected, documented, and popularized by Westerners.]

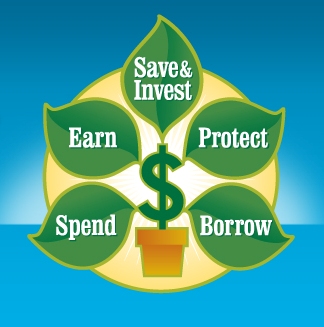

Image Credit: MyMoney.Gov

The purpose of the money-tree image above is to illustrate that strict adherence to a blueprint or action plan provides a big boost towards ensuring success in attaining prosperity in life. Attaining economic prosperity in life includes mastery of principles such as budgeting, earning money, spending money, saving money, borrowing money, investing money, and small business management.

Earning Money through Working

One way to earn money and attain prosperity in life is through a career. In an equal-opportunity society such as the USA, educational achievement significantly increases earning power. The more money you earn, then, the easier it becomes for you to attain prosperity in life. As of 2010, it has been stated that a high school dropout in the USA can expect to earn about $20,000 per year. In contrast, the holder of a college degree in the USA can expect to earn about $50,000 per year—a 150% boost in salary. Clearly, it pays to stay in school. It pays to diligently study your school courses. It does not pay to take education for granted. It does not pay to take the truancy and the dropout routes to education.

For students who think that it is cool to cut classes, sleep in class, daydream in class, or to be disruptive in class, let me assure you that such behavior will only come back to haunt you later in life. When you later become an adult, you will find out that the only thing that you have succeeded in doing is diminishing your earning power in the job market. You will find out that you have fewer job choices because you lack the minimum qualifications to hold many different kinds of jobs. You will be more inclined to participate in the underground economy to make a living such as selling illicit drugs, lying and falsifying documents, stealing, engaging in fraud and swindles, engaging in pimping and prostitution, engaging in human trafficking, robbing others, and so forth. As a consequence of participating in the underground economy, quite likely, you will get arrested by the police, spend time in jail, and have a criminal record to follow you for the rest of your life. Those who do participate in the underground economy face the added risk of becoming victims to hatred, violence, crime, and murder.

Not only is it incumbent upon national leaders and the government to do their parts in fostering prosperity in society but also it is incumbent upon citizens to make a positive difference towards improving their economic lots in life. Citizens can contribute to improving their economic lots in life by keeping abreast of job trends, patterns, and locations. To help ensure a stable, secure, and prosperous financial future, citizens must adapt to these employment trends, patterns, and location. For instance, the USA Bureau of Labor Statistics (BLS)'s website provides a plethora of data on employment trends, patterns, and locations. One key to prosperity in life is to make plans to obtain a career in occupations with the largest job growth potentials and not to acquire job skills in declining occupations. While there are hundreds of occupations and careers from which to choose, as of 2013, some of the hottest job trends include these:

- Job Outlook by Education, 2004-14

- The 2004-14 Job Outlook for College Graduates

- Future Work Trends and Challenges for Work in the 21st Century

- Working in the 21st Century

- Science, Technology, Engineering, and Mathematics (STEM) Occupations: High-tech Jobs for a High-tech Economy

- Going Green: Environmental Jobs for Scientists and Engineers

- College Navigator - National Center for Education Statistics

Earning Money through Saving: Simple Interest

A second way to earn money and secure a prosperous future involves engaging in prudent saving practices. Saving prudently involves obtaining the highest interest rate on an account and also choosing an account that earns compound interest. When it comes to interest, a general rule of thumb is this: If the lifetime of the loan or deposit is for a year or less, then simple interest is expected to be paid or received. If the lifetime of the loan or deposit exceeds a year, then compound interest is expected to be paid or received.

Some savings accounts pay simple interest. The magic-square (or magic-triangle) concept can be used to solve simple-interest problems. When computing simple interest, usually, there is one unknown variable or value that must be computed. When using the magic squares, the shaded square would represent the unknown value or variable. Place your finger over the shaded square, and the remaining squares reveal the formula to compute the unknown (shaded) value.

In the example immediately below this paragraph, principal is given as $5,000, the simple interest rate is given as 8%, and the time period is given as 65 years. Assume you deposited $5,000 into an account that paid an 8% simple interest rate per year. Also, assume that you do not plan to touch the money for 65 years. How much simple interest would you earn? By covering the shaded square, I, the formula shows that you should multiply $5,000 times 8% times 65 years to determine how much interest you would earn, which computes to $26,000. The total amount on deposit after 65 years would be $31,000 (that is, the original $5,000 principal amount deposited plus the $26,000 paid to you as interest).

The formula to compute simple interest was given above and is repeated here as follows:

I = p*r*t (prt)

Where,

- I = interest (simple)

- p = principal (amount deposited)

- r = interest rate

- t = time

I = ($5,000)(0.08)(65)

I = $5,000(5.2)

I = $26,000

The formula to compute the final amount in the account after receiving the simple interest is given as follows:

A = P(1 + rt)

Where,

- A= Amount received

- p = principal (amount deposited)

- r = interest rate

- t = time

A = $5,000[1 + (0.08)(65)]

A = $5,000(1 + 5.2)

A = $5,000(6.2)

A = $31,000

Your initial $5,000 would grow to $31,000 after 65 years if a simple interest rate of 8% per year is being paid (that is, the original $5,000 principal deposit plus the $26,000 that you earned as interest). Your account balance would grow by 520% (that is, from $5,000 to $31,000) over a 65-year period of time. Notice that this 520% increase from $5,000 to $31,000 over a 65-year period of time does not exactly translate into enabling prosperous living.

Earning Money through Saving: Compound Interest

Contrary to simple interest, a principal amount grows exponentially when compound interest is applied. There are four ways to apply compound interest:

- Future value of a lump sum deposit at the beginning of the period.

- Present value of a lump sum deposit at the beginning of the period.

- Future value of periodic deposits at the beginning of the period.

- Present value of periodic deposits at the beginning of the period.

Continuing with the above simple interest example, assume that you are making a one-time, lump-sum deposit into an account at the beginning of the period. You do not intend to touch the money for the next 65 years. The following future value formula for a lump sum deposit shows how your $5,000 deposit would grow exponentially over time when using annual compounding periods and an 8% interest rate.

Where,

- AF = [lump sum] amount in the future, or future value in the account after t time periods

- PVD = present value of the lump sum deposit

- r = periodic interest rate or annual interest rate

- t = length of time (usually in years) the funds are to be deposited

- n = number of compounding periods in the year

And Where the number (n) of compounding periods (factors) are,

- 360 = daily compounding

- 52 = weekly compounding

- 12 = monthly compounding

- 4 = quarterly compounding

- 2 = semiannual or twice yearly compounding

- 1 = annual or yearly compounding.

The above formula was used to determine the future value of a lump sum deposit. The formula took the current or present amount ($5,000) and computed its future value ($743,899.23) after 65 years on deposit. The present value was known and the future value needed to be computed.

Notice the difference between simple interest and compound interest. The household who deposited its $5,000 into a regular savings account paying a simple interest rate of 8% per year will have a total of $31,000 on deposit at the end of 65 years (a 520% increase). In contrast, the household who deposited its $5,000 into an account receiving 8% interest compounded annually will have $743,899.23 on deposit at the end of 65 years (a 14,778% increase). Through the magic of compounding, your $5,000 lump-sum deposit has enabled you to attain a measure of prosperity. However, it should be noted that, if you made the $5,000 lump-sum deposit into an account at age 25, then 65 years later would equate to an age of 90.

The point to remember is this: A savings program is essential if you wish to make your money grow. For phenomenal growth, you must secure a compound interest rate, and you must be very, very patient and disciplined. Equally important, you have to start saving at an early stage in your life.

Households have to take the initiative to find saving instruments that pay compound interest. Household also must be willing to leave the funds on deposit in the account for a very long period of time to reap the full benefits of compounding. The IRA account represents one such financial instrument that pays compound interest.

A related formula holds true, that is, the formula for determining the present value of a lump sum deposit at the beginning of the period. In this particular case, you already know what specified amount that you desire to have in the future. The task becomes one of determining what lump sum deposit amount that you should make today in order to attain the specified future amount.

For the sake of simplicity and continuity, assume that you are 25 years old. You decide that you would like to have $743,899.23 on deposit by the time you reach age 90. What lump sum amount should you deposit today in order to attain $743,899.23 in 65 more years from today? To solve this problem, you would use the formula for determining the present value of a lump sum deposit. The formula is given as follows:

Where,

- AP = [lump sum] amount required in the present (today) for a specified future value in the account in the future after t time periods

- FVD = future value desired

- r = periodic interest rate or annual interest rate

- t = length of time (usually in years) the funds are to be deposited

- n = number of compounding periods in the year

And Where the number (n) of compounding periods (factors) are,

- 360 = daily compounding

- 52 = weekly compounding

- 12 = monthly compounding

- 4 = quarterly compounding

- 2 = semiannual or twice yearly compounding

- 1 = annual or yearly compounding.

The present value formula for a lump sum deposit shows that, to attain an account balance of $743,899.23 in 65 years from today, then you would need to make a $5,000 lump sum deposit into an account today. It is assumed that the account will be receiving 8% interest compounded annually. Because it is assumed that you made the lump sum deposit at age 25, you actually will be 90 years old when the account reaches a balance of $743,899.23.

It turns out that many households are not always financially able to make a one-time, lump sum deposit into a compound interest account to jumpstart their savings plan. Some households need to jumpstart their savings plan by making smaller, periodic deposits into the compound interest account, say, on a monthly or quarterly basis. The future value and present value of periodic deposits formulas were designed for cases whereby you are not financially able to make a lump sum deposit into an account that pays compound interest.

Once again, for the sake of simplicity and continuity, assume that you are 25 years old. You decide that you would like to have $743,899.23 on deposit by the time you reach age 65 instead of age 90. What periodic deposits should you make today in order to attain $743,899.23 in 40 years from today? In this particular case, you already know what specified amount that you desire to have in the future. The task becomes one of determining the precise amount that you periodically must deposit into the account to attain the specified ($743,899.23) future amount. To solve this problem, you would use the formula for determining the present value of periodic deposits. The present value of periodic deposits formula is given as follows:

Where,

- DEP = the amount to be periodically deposited into the account today

- FVD = future value desired

- r = periodic interest rate or annual interest rate

- t = length of time (usually in years) the funds are to be deposited

- n = number of compounding periods in the year

And Where the number (n) of compounding periods (factors) are,

- 360 = daily compounding

- 52 = weekly compounding

- 12 = monthly compounding

- 4 = quarterly compounding

- 2 = semiannual or twice yearly compounding

- 1 = annual or yearly compounding.

In the above example, you would need to deposit $211.68 into the account on the first day of the month for the next 40 years to attain the $743,899.23 desired by the time you are 65 years old. It is assumed that the interest rate you'll be receiving on the $211.68 deposits is 8% compounded monthly.

The next scenario computes the future value of periodic deposits. In this example, assume that you are 25 years old and only can afford to deposit $211.68 monthly into a compound interest account. You decide that you will start using the money in the account when you turn 65 years old. You wish to know how much money will have accumulated in the account. In this instance, the present value of the deposits is known and the future account value needs to be computed.

To solve this problem, you would use the formula for determining the future value of periodic deposits. The future value of periodic deposits formula is given as follows:

Where,

- FVA = future value of the periodic deposits

- DEP = the amount periodically deposited into the account today

- r = periodic interest rate or annual interest rate

- t = length of time (usually in years) the funds are to be deposited

- n = number of compounding periods in the year

And Where the number (n) of compounding periods (factors) are,

- 360 = daily compounding

- 52 = weekly compounding

- 12 = monthly compounding

- 4 = quarterly compounding

- 2 = semiannual or twice yearly compounding

- 1 = annual or yearly compounding.

Earning [and Losing] Money through Investing

A third way to earn money and secure a prosperous future involves investing. One of the most important thing to remember about investing is that investing involves both risks and rewards. Investment types are usually placed on a sliding scale based on their riskiness. Investments run the gamut from being very safe to being very unsafe. Some typical investment vehicles include stocks and bonds, real estate, mutual funds, stock options, annuities, commodities, foreign currency exchange, precious metals, business ownership (such as partnerships and proprietorships), and so forth.

No investment is 100% safe. Investing is not always a win-win proposition. You stand to lose as equally as you stand to gain from a given investment. Sometimes you invest money and win a big payoff, and other times you invest money and lose all the money that you invested. In general, the riskier the investment, then higher is the return that is paid. For example, USA Treasury bills are very safe investments. They pay very low interest rates. Investing in minerals, oil, and gas (MOG) rights is very risky. There is a high probability that the investment will fail. When MOGS are successful, they pay very high returns.

Another important thing to remember about investing is this: It usually is not wise to place all your eggs in one basket, so to speak. For example, if you have an aversion for investing in stocks, then your stock portfolio should not be invested 100% in the stock of a single company. Instead, to safeguard against losses, your stock portfolio should contain a mixture of stocks from multiple companies located in a variety of industries. Another thing to remember is this: When investing, always try to invest in a relatively safe instrument that simultaneously pays a rate of return on par with earning compound interest.

The problem with some risky investments is the preponderance of crooks, scam artists, and swindlers. Unless you take steps to mitigate these risks, as the adage goes, "a fool and his money are soon parted." The following web links offer insights into of some of these scams, schemes, and swindles:

Earning [and Losing] Money through Business Ownership

A fourth way to earn money and secure a prosperous future involves ownership of a small business. An important statistic is worth noting: It has been stated that roughly 95% of all newly started businesses in the USA usually fail within their first three years of operations. Several reasons are given for this extremely high business-failure rate. One reason is that the business owner did not pre-plan properly and did not have a formal operational strategy in place on which to execute.

For aspiring small business owners, there should be no illusions about running a business. There is no guarantee that you will succeed as the owner of your own business. For instance, you can be one of the greatest automobile mechanics on planet Earth and yet still witness your auto mechanic shop fail. Not only would your automobile mechanic skills matter in running a successful automobile mechanics business but also there is a host of other tangible traits that you would need to bring to the table, so to speak (such as a business plan; an organized system of bookkeeping and accounting; judicious pricing; running marketing and advertising campaigns; adroit managerial controls over things like production quality, product mix; technological mix; following best buying, selling, and personnel practices; a web presence, and so forth). To run a successful business, additionally, you would need to bring the right intangible mix to the table (such as a good business location; ambience; good customer service; good public relations; being attuned to client tastes, preferences, and trends; being attuned to the activities of your business competitors; being responsive to government regulations; being mindful of positive publicity, and so forth). The motion picture Coming to America (John Landis) contained a comedic subplot about how the entrepreneur named McDowell kept too close of an eye on the activities of his business competitor named McDonald's.

There are several points of entry into the world of business ownership. You can become a manufacturer. As a manufacturer, you take raw materials and covert them into a product that is valued in the economic marketplace. You would sell this highly valued product to consumers for a profit. A manufacturer could be as large as General Motors, which takes raw materials and parts and converts them into automobiles. A manufacturer could be as small as the neighborhood child who makes and sells glasses of lemonade on a scorching hot summer day. For the glasses of lemonade, the child would be using the raw materials of lemons, water, sugar, and ice to produce highly valued glasses of ice cold lemonade.

A second point of entry into business ownership is as a reseller and wholesaler. The reseller usually purchases the finished products from the manufacturer and resells them to consumers at a price that is slightly higher than the reseller's purchase price. Retail stores are classified as resellers. Going back to the automobile example, the dealership would be a reseller. Using the lemonade example, a reseller could be another child in the neighborhood who purchases all the glasses of lemonade and resells them to construction workers for a higher price at a nearby construction site a few blocks away.

A third point of entry into the world of business ownership is to become a service provider. In providing a service to consumers, you are offering something for sale that is intangible but highly valued. To use the automobile example, the dealership usually doubles as a service provider. The dealership also would repair and maintain your vehicle for a fee. For the lemonade stand, another friend might offer a service of dismantling the stand, cleaning the equipment, and cleaning up the area for a fee.

These three business entry points—manufacturers, reseller, and service providers—represent the essence of the free enterprise system. The idea is to purchase your inputs (for example, raw materials) for a lower price than the price that you charge your customers for the outputs (for example, a finished automobile). The difference would be your profit. The operation of the stock market is based on this simple premise: Buy low, receive dividends (a form of interest), and sell high for a net profit.

Generally speaking, households offer their labor services to business owners in exchange for salaries. Household labor services include specific knowledge, skills, talents, routines, and experiences. The employer-employee working relationship usually runs very smoothly. Occasionally, misunderstandings arise between employers (business owners) and employees (households), and on-the-job friction ensues. Often, employees are disgruntled because they think that their employers are not fairly sharing the company's profits with them.

In other instances, employees are disgruntled because they think that the employer's work requirements are unreasonable and the production goals are too difficult to meet. Labor unions, in part, were born because employees thought that their employers were being overly unreasonable. These disgruntled employees joined labor unions to seek redress of some basic work grievances. It further should be noted that one grievance against labor unions is this: With the passage of time, labor unions, too, tend to become restrictive and exclusive clubs that have the effect of limiting access to jobs. Another grievance against labor unions is that, with the passage of time, labor unions, too, begin to make their own overly unreasonable demands on their employers.

There is no shortage of tools available in the economic marketplace to assist those households who also wish to become successful small business owners. That is, books, videos, websites, software applications, workshops, seminars, and so forth, are available. References to some of these websites and so forth are contained in the tips, tricks, tools, and resources section below.

The point of going into business is threefold: (1) to do the type of work that you enjoy as a profession, (2) to provide consumers with a desirable product, and (3) to make a profit (that is, a positive difference between revenue and expenses). To survive in business, you have to be assured of making a profit. At a minimum, before launching the business, you have to plan for profitability.

One tool for performing a preliminary profitability analysis is known as break-even analysis or cost-volume-profit analysis. Break-even analysis is particularly useful when only one product is involved but also can be adapted to cover multiple products. Break-even analysis entails precisely determining the minimum units of a product that you need to sell in order for the business venture to break even and, ultimately, to make a profit given its prevailing price and cost structure.

One of the more simpler break-even formulas is written as follows:

Where,

- B = Break-even point (unknown)

- F = Fixed costs total

- S = Selling price per unit

- V = Variable cost total per unit

After substituting values for the break-even variables F, S, and V into the formula, the profit-yielding quantity becomes known. The following videos provide an overview of the break-even analysis procedure.

Another important component of business ownership is to have an accounting system in place. A financial accounting system enables you to keep close control over the business's finances. There are numerous accounting software applications in the economic marketplace. Not only do these accounting applications automate the accounting process for you but also these applications provide reports to help you analyze the business's solvency and profitability.

If, for instance, you plan to start a business because you are adept at producing a particular good or service but are not too savvy when it comes to, say, management chores or bookkeeping chores, then you might wish to consider hiring a business manager or an accounting manager who is adept at performing these kinds of chores. At a minimum, you should consider hiring a reputable Certified Public Accountant (CPA) or a reputable Chartered Financial Analyst (CFA) to help ensure that your business is operating on sound financial grounds. To learn the intricacies of running a business, students are encouraged to pursue a college degree in business administration.

Time management is crucial for the small business owner. Two of life's objectives are to live prosperously and to enjoy life. All too often the small business owner spends an inordinate amount of time trying to build and maintain a profitable business. Instead of enjoying life, all too often the small business owner suffers from stress, fatigue, exhaustion, and burnout as a result of overworking. To make the most efficient use of your time as a small business owner, you might wish to consider integrating some form of time-management strategy into daily work routines. There are numerous time-management software applications in the economic marketplace.

Earning [and Losing] Money through Playing the Lottery

One way in which some people attempt to make a lot of money quickly and legally is by playing the lottery. Giving the astronomical odds against winning the lottery, playing the lottery probably is not exactly the wisest route to prosperity. However, for the lucky few who do win the lottery jackpot, the payoff from their $1 investment can be phenomenal. It is not everyday that you can take, say, $1, and turn it into, say, $10,000,000 (million) in a matter of seconds and not have to do any work to earn the $10 million. I think that the prospect of turning $1 into millions of dollars is what entices so many humans to play the lottery. Moreover, some lottery players would be content to win, say, $75,000 in exchange for their $1 investment.